How to Buy Crypto Bonds on HIBT: A Step-by-Step Guide

As the cryptocurrency market continues to evolve and expand, new investment opportunities are emerging, with crypto bonds gaining traction among investors. In fact, according to recent reports, the global crypto bond market is expected to grow significantly in the coming years, reflecting a growing interest in alternative investment options. With more than $4.1 billion lost to hacks in decentralized finance (DeFi) platforms in 2024, safety and security in crypto investments have never been more palpable. If you are wondering how to buy crypto bonds on HIBT, you have come to the right place.

Understanding Crypto Bonds

Before delving into how to purchase crypto bonds on HIBT, let’s briefly understand what these assets entail. Crypto bonds are debt instruments that leverage blockchain technology to provide investors with a unique platform for accessing interest-bearing bonds. They offer not only the appeal of conventional bonds but also characteristics inherent to cryptocurrencies, such as decentralization and the potential for high returns.

In Vietnam, where the user growth rate in cryptocurrency markets has reached 37%, understanding crypto investments becomes essential for users looking to maximize their gains.

Key Benefits of Crypto Bonds

- Higher returns: Compared to traditional bonds, crypto bonds can offer significantly higher returns due to their innovative structure.

- Liquidity: Being based on blockchain, these bonds can be traded on various platforms, giving investors flexibility.

- Security: Utilizing smart contracts and blockchain technology enhances transparency and the overall security of the investment.

Exploring HIBT for Crypto Bonds

The HIBT platform (Hyper Innovative Blockchain Technology) provides a robust space for initiating your journey into crypto bonds. It’s essential to familiarize yourself with the platform before making any investments. HIBT offers various tools for managing digital assets, supports multiple cryptocurrencies, and has a user-friendly interface to enhance your investment experience.

Here’s the catch: register on HIBT, verify your identity according to local regulations, and ensure your investment is compliant with Vietnamese law (tiêu chuẩn an ninh blockchain).

Registration and Account Setup

- Visit the HIBT website.

- Click on ‘Sign Up’ and provide the required information, including your email and password.

- Verify your email to activate your account.

- Complete your KYC (Know Your Customer) verification by providing identification documents.

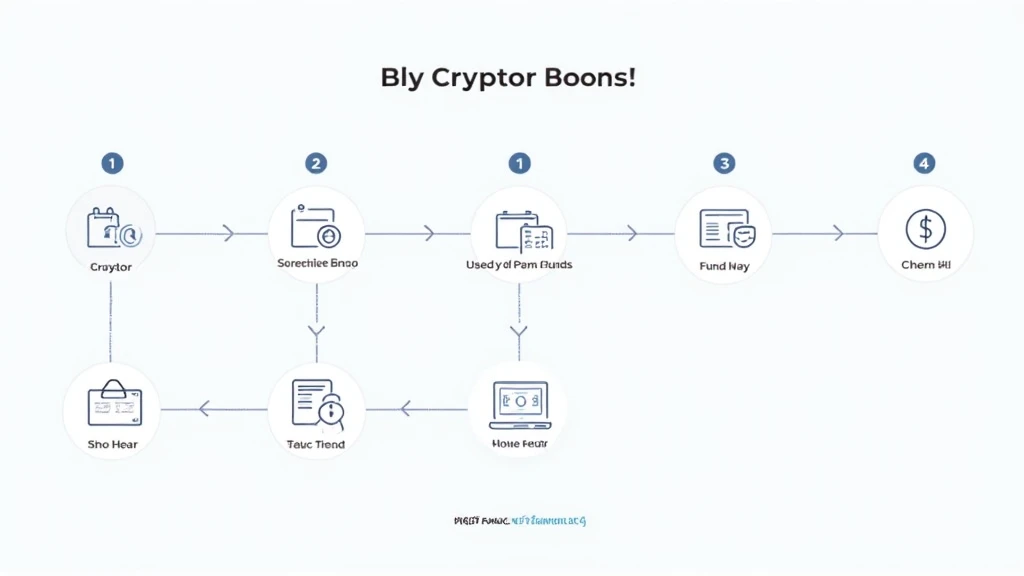

How to Fund Your HIBT Account

After setting up your account, the next step involves funding it to buy crypto bonds. Here’s how:

- Log into your HIBT account.

- Navigate to the ‘Deposit’ section and choose your preferred cryptocurrency or fiat currency to deposit.

- Follow the on-screen instructions to complete the deposit; note any transaction fees involved.

Purchasing Crypto Bonds on HIBT

Now that your account is funded, let’s break it down to the buying process for crypto bonds:

- Go to the ‘Marketplace’ section on HIBT.

- Look for the available crypto bond offerings.

- Choose the bond that aligns with your investment objectives. Consider factors like bond ratings, interest rates, and maturity dates.

- Click ‘Buy’ and enter the amount you wish to purchase.

- Review the transaction details. Ensure you understand the obligations regarding payouts and terms.

- Submit your purchase, and confirm that the bonds are now listed in your portfolio.

Monitoring Your Crypto Bond Investment

Once you have purchased your crypto bonds, it’s crucial to keep track of their performance. HIBT’s platform provides tools and resources to monitor the status of your investments.

- Check: Ensure you regularly check interest payments and market conditions.

- Stay Informed: Follow HIBT news and updates for potential changes that could affect your bonds.

- Evaluate: Reassess your portfolio periodically to ensure it fits within your financial goals.

Case Study: Success in Crypto Bonds

To illustrate the potential benefits of investing in crypto bonds, let’s take a fictional case study. A Vietnamese investor, Ms. Lan, entered the crypto bond market by purchasing bonds worth 5 BTC on HIBT with an interest rate of 8% over a 3-year period. By diligently monitoring her investments and reinvesting the interest earned, she was able to significantly boost her earnings as the market matured.

Conclusion

Buying crypto bonds on HIBT can be an excellent investment opportunity, particularly as the cryptocurrency market continues to evolve and attract more participants. By understanding how to navigate the platform, funding your account, and purchasing bonds, you can position yourself for potential gains while managing risks effectively. As always, remember that investing in cryptocurrencies comes with its risks, and it’s advisable to conduct thorough research or consult with a financial advisor before making significant investment decisions.

In the fast-paced world of digital assets, adhering to 2025’s essential blockchain security practices and leveraging platforms like HIBT can help ensure the safety and growth of your investments.

Be proactive, educate yourself, and stay ahead of the curve as you explore the exciting realm of crypto bonds.

For more information on crypto investment strategies, don’t forget to check out our other articles here on coincollectorcentral.

About the Author

Jane Doe is a recognized expert in blockchain technology and investment strategies, with over 50 published papers in various financial journals. She has led audit projects for prominent crypto firms, advocating for best practices in the industry.