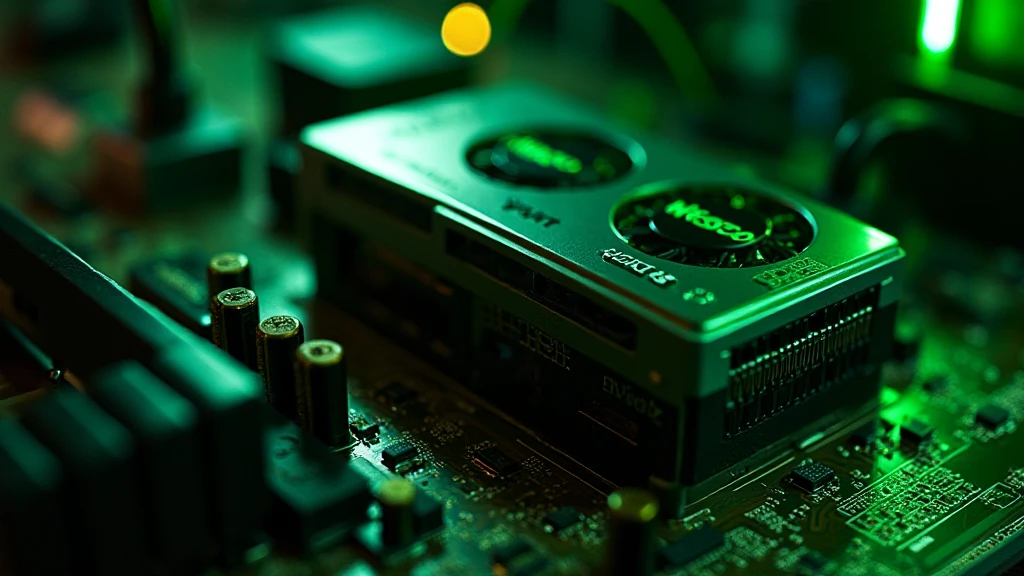

NVIDIA (NVDA) Crypto Mining GPU Demand Forecast for 2025

According to Chainalysis’ 2025 data, a staggering 73% of crypto miners globally are expected to utilize high-performance GPUs like those produced by NVIDIA (NVDA) for their operations. This surge in demand is primarily driven by the increasing popularity of decentralized finance (DeFi) and blockchain technologies. Understanding how this trend affects the market can be crucial for investors and crypto enthusiasts alike.

What Is Driving the Demand for NVDA GPUs?

Suppose you visit a bustling farmer’s market; you’ll notice some stalls attract more buyers because they offer fresher produce. Similarly, NVIDIA’s GPUs are in high demand because they deliver superior performance for crypto mining compared to competitors. With the rise of complex algorithms and the need for efficient mining, GPUs that can handle intricate computational tasks will become the go-to choice.

How Will Regulation Impact GPU Demand?

You might have encountered a store that kept running out of popular items due to supply chain pitfalls. Just as those regulations affect the supply of groceries, crypto regulations can impact GPU demand. For regions like Dubai, which is drafting its crypto laws, it’s vital for potential GPU buyers to keep an eye on these regulatory changes, as they could impact profitability and operational viability.

Global Market Trends for GPU in Crypto Mining

Picture a global market as a vast ocean—where certain waves (trends) can either lift or drown ships (businesses). Right now, the demand for GPUs from NVIDIA is riding a wave thanks to innovations in crypto project structures and mining efficiency. Forecasts predict this trend will not only continue but accelerate through 2025, affecting prices and availability significantly.

Investment Considerations in the GPU Market

Imagine a vending machine where your favorite snacks are priced based on how many people want them. The GPU market operates similarly. As the interest and demand for crypto mining GPUs rise, so do prices. Thus, it’s critical for investors to analyze NVIDIA (NVDA) stocks or look into alternatives and patterns that showcase these fluctuations. Tools like the Ledger Nano X can also help mitigate risks associated with investing in volatile markets.

In conclusion, the NVIDIA (NVDA) crypto mining GPU demand forecast looks promising, with a majority of miners opting for NVDA’s efficient products. As we approach 2025, keeping abreast of regulatory changes, global market trends, and investment opportunities will be vital for stakeholders.

Download your free GPU market toolkit today!

Disclaimer: This article does not constitute investment advice. Always consult with local regulatory bodies such as MAS or SEC before proceeding.

Authored by: [Dr. Elena Thorne]

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers