2025 Cross-Chain Bridge Security Audit Guide

As per Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities that could be exploited by malicious actors. With the increasing adoption of cryptocurrency, ensuring secure transactions across different blockchain networks has never been more crucial. This article delves into the rising trend of Bitcoin anti-security measures and offers practical solutions for safeguarding your digital assets.

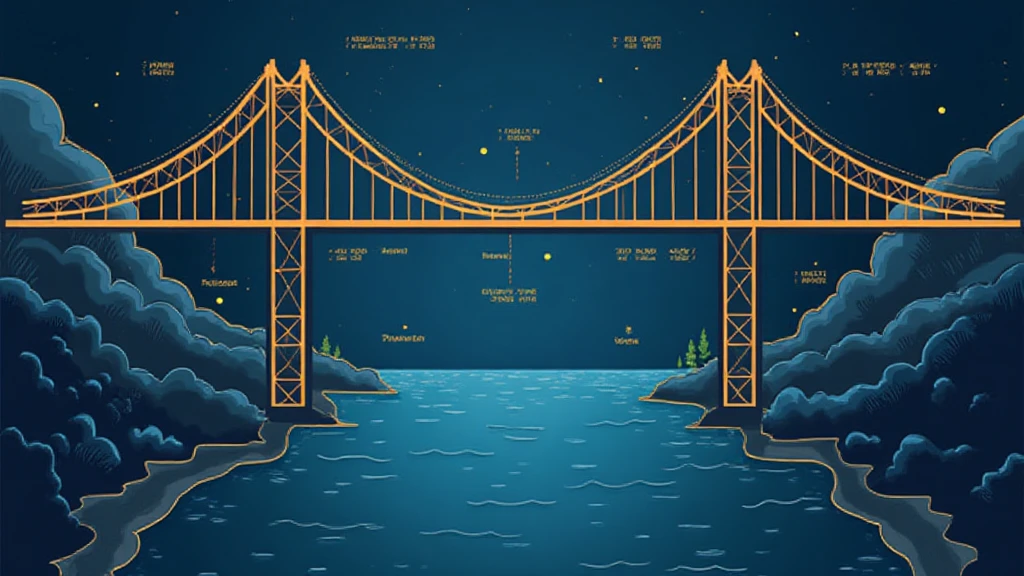

Understanding Cross-Chain Interoperability

Think of cross-chain bridges like currency exchange booths at an airport. They allow you to swap one type of currency for another, but can be risky if they don’t follow security protocols. The challenge lies in ensuring that your digital assets remain safe while transferring them across different blockchains. In 2025, we anticipate regulations in regions like Dubai aimed at enhancing security in these transactions.

Implementing Zero-Knowledge Proofs

You may have heard of zero-knowledge proofs (ZKP) as the secret handshake that verifies your identity without revealing personal information. It’s like showing your ID to a bouncer at a club without giving away your name. By utilizing ZKP in cross-chain transactions, users can bolster privacy and security. Incorporating these techniques will be pivotal in Bitcoin anti-security strategies moving forward.

Energy Consumption Comparison of PoS Mechanisms

For those curious about energy efficiency, comparing Proof of Stake (PoS) mechanisms can resemble choosing between electric and gas-powered cars. Both get you to your destination, but one might save you money in the long run. As we adopt PoS more broadly, understanding its energy implications should influence Bitcoin anti-policies in environmentally conscious jurisdictions.

Future Trends in DeFi Regulation

Imagine if your favorite coffee shop suddenly had to follow new rules about how they serve drinks. This is what’s happening in DeFi. By 2025, we expect significant regulatory changes in places like Singapore, impacting how decentralized finance platforms operate. Staying informed about these trends is crucial to crafting effective Bitcoin anti-strategies and ensuring compliance.

In conclusion, securing cross-chain transactions requires a multi-faceted approach, integrating innovative technologies like zero-knowledge proofs and staying updated with regulatory shifts. Download our toolkit for further insights on how to protect your crypto assets today!