2025 Cross-Chain Bridge Security Audit Guide

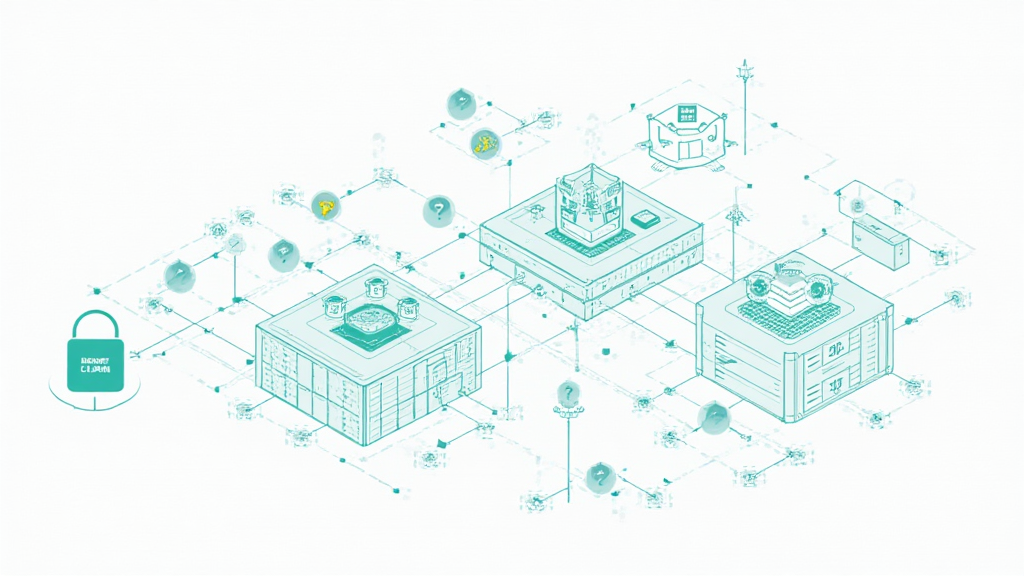

According to Chainalysis, 73% of cross-chain bridges worldwide are vulnerable as of 2025, highlighting an urgent need for enhanced security protocols in the HIBT decentralized finance protocols.

What are HIBT Decentralized Finance Protocols?

Think of HIBT decentralized finance protocols as your neighborhood bank but online—allowing users to deposit, lend, and borrow without a middleman. They utilize smart contracts to automate transactions and ensure security, similar to how an automated teller machine (ATM) functions to dispense cash without human intervention.

Why Cross-Chain Interoperability Matters

Cross-chain interoperability is like having a universal translator at a travel hub, allowing various cryptocurrencies to communicate and transact seamlessly. As users increasingly seek to make transactions across different blockchain networks, protocols that facilitate this communication will see greater adoption.

Zero-Knowledge Proofs: Enhancing Privacy

Consider zero-knowledge proofs as a bouncer at a club who verifies your age without asking for your ID. This technology ensures that users can confirm transactions without revealing any sensitive information, making it vital for privacy within the HIBT decentralized finance protocols.

Comparing PoS Mechanism Energy Consumption

When you think about PoS mechanisms, imagine comparing two light bulbs: one energy-efficient and another that consumes more power. In the context of HIBT decentralized finance protocols, understanding the energy consumption of different consensus mechanisms can help determine the sustainability of your investments in the long term.

Conclusion

In summary, navigating HIBT decentralized finance protocols requires awareness of security vulnerabilities, interoperability needs, privacy enhancements, and energy consumption. To stay informed, download our comprehensive tool kit for best practices in decentralized finance.