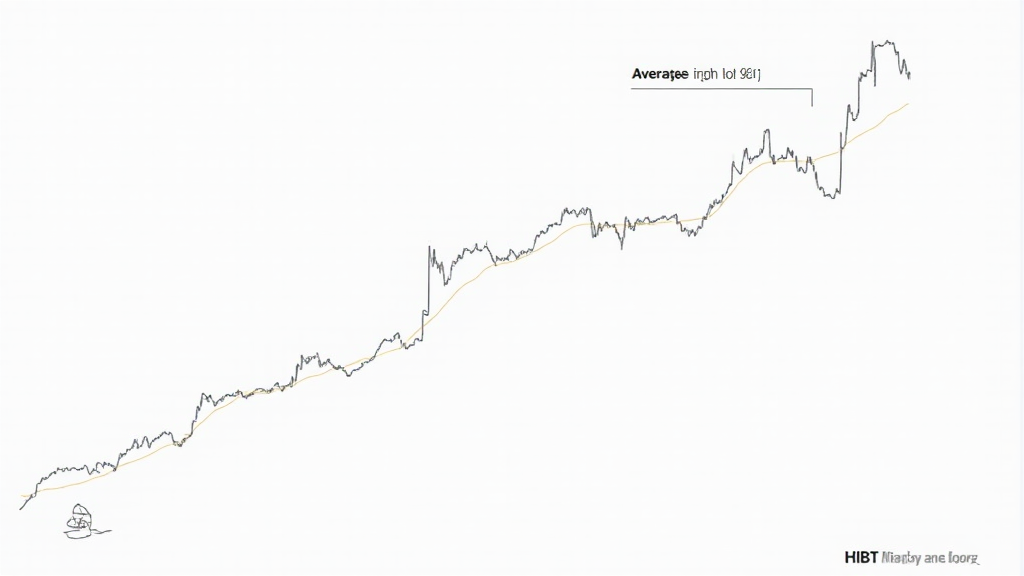

Is the HIBT Moving Average Strategy Effective?

According to Chainalysis’s 2025 data, a staggering 73% of traders struggle with volatility in the crypto market. The HIBT moving average strategy stands out as a tool to help address these challenges by smoothing out price fluctuations. Think of it like a seasoned vendor at a market: they know exactly when to buy fresh produce and when to sell it, avoiding losses during price dips.

How to Implement the HIBT Moving Average Strategy?

Implementing this strategy is similar to making a shopping list before hitting the market. Identify your entry and exit points based on historical data. Just like how a market vendor picks the best prices, you’ll need to analyze price trends using HIBT to optimize your trades. It’s all about timing—knowing when to dive into the market and when to back off.

What Are the Benefits of the HIBT Moving Average Strategy?

This strategy not only helps in mitigating risks but also in making informed decisions based on empirical data. Unlike guessing, it’s like using a map in an unfamiliar city: it helps you avoid wrong turns. With the volatile nature of cryptocurrency values, utilizing HIBT can provide a clearer path to profitability.

Common Mistakes to Avoid with HIBT Moving Average Strategy

Even seasoned traders can falter. A common mistake is not adjusting settings according to market conditions. It’s like a food stall failing to adapt the menu based on seasonal produce. Be sure to stay updated and adjust your strategy accordingly based on current crypto trends to maintain a competitive edge.

In conclusion, embracing the HIBT moving average strategy could significantly enhance your trading experience. For further insights, consider downloading our comprehensive trading toolkit from HIBT