Vietnamese Crypto Investment Funds and Their Impact on the Future of Digital Assets

According to Chainalysis 2025 data, a staggering 73% of investment funds in the crypto sector face significant vulnerabilities, especially in emerging markets like Vietnam. As the interest in digital assets surges, many investors are turning to Vietnamese crypto investment funds for growth opportunities, but how secure and effective are these investments?

What Are Vietnamese Crypto Investment Funds?

Imagine walking into a local market where you have various stalls for different goods. Each stall represents a different investment strategy, and each vendor is vying for your attention. This is akin to Vietnamese crypto investment funds, which are diverse and cater to various investor needs—from those looking for short-term gains to those aiming for long-term wealth accumulation.

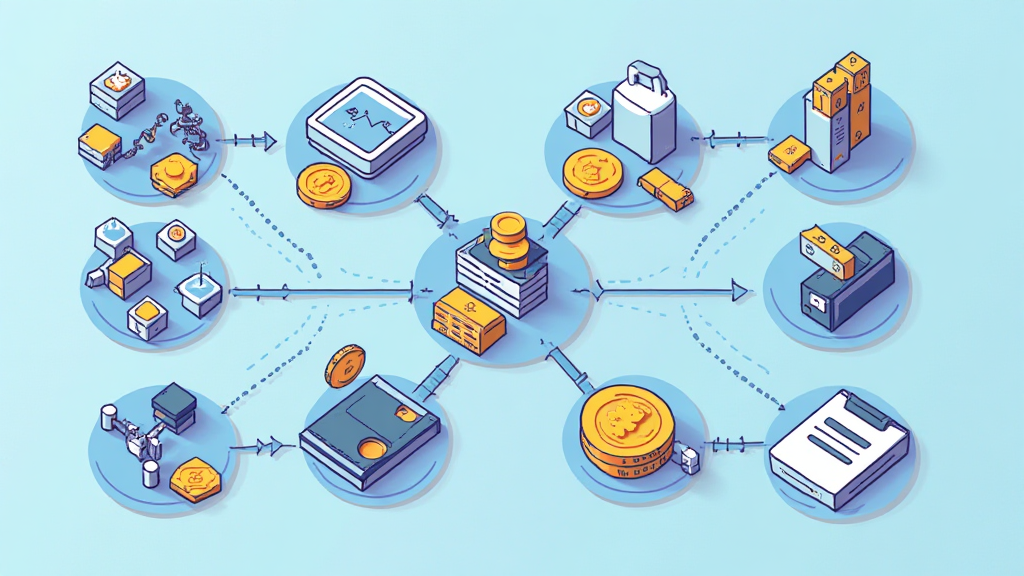

The Role of cross/”>Cross-Chain Interoperability in Crypto Investments

You might have encountered a situation where you need to exchange money while traveling abroad, tinkering with exchange rates. cross/”>Cross-chain interoperability functions similarly, allowing different blockchains to communicate with one another. This is essential for Vietnamese crypto investment funds as it enhances investor flexibility, enabling funds to interact with multiple cryptocurrencies easily.

Zero-Knowledge Proof Applications: Adding Security

Think of zero-knowledge proofs like sending a parcel without revealing its contents. These cryptographic techniques are crucial for maintaining privacy in transactions. Vietnamese crypto investment funds are increasingly adopting such technologies to bolster investor confidence by ensuring that sensitive information remains confidential, thus reducing fraud risks.

Expectations for 2025: Regulatory Climate for DeFi in Vietnam

2025 is just around the corner, and investors are eager to understand how regulations will shape the future of decentralized finance (DeFi) in Vietnam. Local authorities are preparing frameworks to facilitate growth, similar to how municipalities set rules for a new shopping district. This is vital for Vietnamese crypto investment funds, as a clear regulatory environment encourages more investments.

To wrap up, Vietnamese crypto investment funds are becoming increasingly relevant in the crypto space, providing valuable opportunities while navigating unique challenges. Investors should stay informed and consider tools like the Ledger Nano X, which can reduce the risk of private key theft by up to 70%.

For a deeper dive into best practices for crypto investments, download our comprehensive toolkit today and stay ahead of the game!

Disclaimer: This article does not constitute investment advice. Always consult local regulatory authorities before making investment decisions.

For more insights, refer to our cross-chain security white paper and discover strategies for successful investing.

Published by coincollectorcentral.