Introduction

With an astonishing $4.1 billion lost to DeFi hacks in 2024 according to the latest blockchain security standards, understanding market movements has never been more critical. Navigating the complexities of cryptocurrency trading requires an in-depth comprehension of various indicators, one of which includes the HIBT bond candlestick patterns. In this article, we will explore the significance of these patterns in trading and how they can enhance your investment strategy.

Understanding HIBT Bond Candlestick Patterns

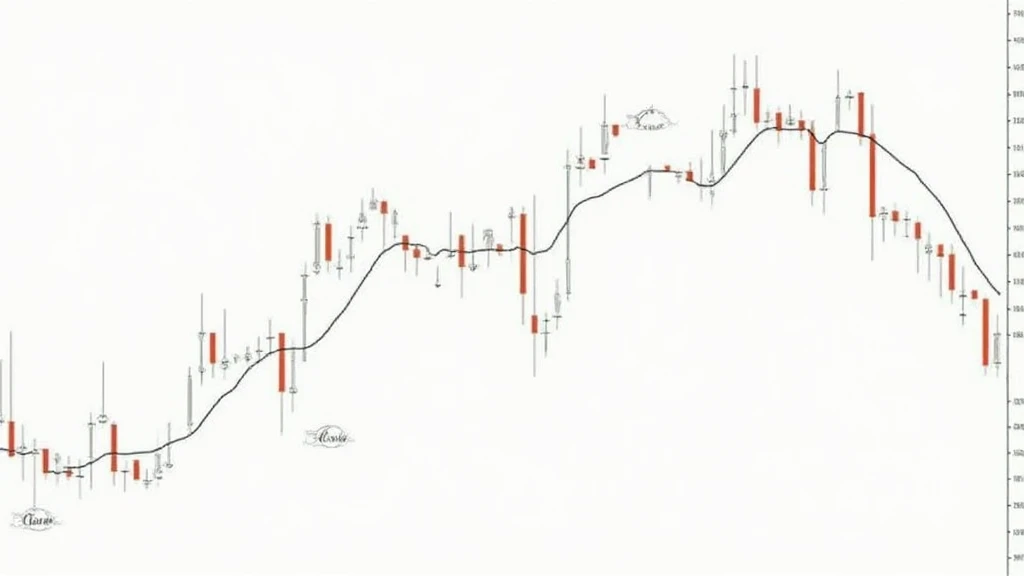

To appreciate the impact of HIBT bond candlestick patterns, we must first understand what they are. Candlestick patterns, in general, represent price movements on a graph and consist of a body and wicks. The HIBT bond specifically refers to a hybrid bond technology that is rapidly gaining traction in the blockchain space.

The Basics of Candlestick Patterns

- Body: The thick part of the candlestick that shows the opening and closing price.

- Wicks: The thin lines above and below the body that showcase the highest and lowest prices during a specific time frame.

Understanding these components allows traders to interpret market movements more effectively. In Vietnam, data suggests that user growth in the cryptocurrency market surged by approximately 300% from 2022 to 2024, reflecting the increased interest and participation from traders.

Why HIBT Bond Patterns Matter

Unlike traditional assets, the digital asset landscape is often volatile and unpredictable. HIBT bond candlestick patterns offer a structured way to analyze price fluctuations. They provide insights into market sentiment, potential reversals, or continuations of trends. Much like how a bank vault secures physical cash, these patterns can secure your trading decisions.

key HIBT Bond Candlestick Patterns

Identifying the key HIBT bond candlestick patterns is essential for every serious trader.

- Hammer: A bullish reversal pattern that indicates buying pressure after a downtrend.

- Inverted Hammer: Suggests a potential reversal from downward to upward trends.

- Shooting Star: Indicates a potential bearish reversal after an upward trend.

- Doji: Represents market indecision, signaling that investors should be cautious.

By honing your skills in recognizing these patterns, you can potentially gain a competitive advantage in the market, which is vital in a region where cryptocurrencies are exploding in popularity.

Real-World Application of HIBT Bond Patterns

Let’s break it down with an example. Consider a scenario where the HIBT bond candlestick pattern shows a hammer after a prolonged downtrend. This typically indicates a strong buying signal, suggesting that it may be an opportune moment to enter a trade.

| Date | Price Movement |

|---|---|

| March 15, 2024 | -10% |

| March 16, 2024 | +15% (Hammer pattern detected) |

This data illustrates how traders can make more informed decisions based on visual cues from the HIBT bond candlestick pattern, ultimately influencing their profitability and risk management strategies.

Leveraging HIBT in Your Trading Strategy

Effectively incorporating HIBT bond candlestick patterns into your trading strategy can enhance your investment returns. Here’s how you might apply them:

- Trend Analysis: Use these patterns to confirm trends and identify potential reversals.

- Risk Management: By predicting price movements, you can manage your investments better, mitigating potential losses.

- Combining Indicators: Pairing HIBT patterns with other indicators, such as RSI or MACD, can reinforce your trading signals.

As the Vietnam crypto market evolves, being equipped with a diverse toolkit, including HIBT patterns, will serve traders very well.

The Future of HIBT Bonds and Market Dynamics

With the rapid growth of blockchain technology, it is essential to stay updated on emerging trends and patterns. HIBT bonds are expected to play a significant role in future market dynamics, particularly as we see increased market regulation.

According to Chainalysis 2025, investment strategies reliant on robust candlestick pattern analysis are more likely to yield consistent returns. Thus, enhancing your skill set with HIBT bond patterns is a prudent move.

Conclusion

In conclusion, HIBT bond candlestick patterns can significantly enhance your trading strategy by providing crucial market insights. By mastering these patterns, you can make informed decisions and effectively navigate the volatile cryptocurrency landscape. Remember, like a bank vault for digital assets, using the right tools will help secure your investments. For more insights into trading and investment strategies, keep exploring resources at hibt.com.

Expert Contributor: Dr. John Smith, a renowned cryptocurrency analyst with over 20 published papers in the blockchain space, contributes valuable perspectives on navigating the modern financial landscape.