HIBT vs Coinbase Bond Platform: The Future of Crypto Investment

With over $4.1 billion lost to DeFi hacks in 2024, security and trust in crypto platforms have never been more crucial. As the digital currency landscape evolves, platforms like HIBT and Coinbase are redefining investment strategies. This article aims to provide a comprehensive comparison of HIBT and Coinbase’s bond platforms, weighing their unique advantages and challenges. We will delve into the intricate details of these platforms, focusing on security measures, user experience, and potential returns on investment.

Understanding the Bonding Concept in Crypto

Before diving deep into the comparison, it’s essential to understand what a bond platform is in the context of cryptocurrency. Unlike traditional bonds, which are debt securities issued by entities seeking to raise capital, crypto bond platforms facilitate investments in blockchain-backed assets. This unique mechanism allows investors to earn passive income through tokenized bonds while ensuring security through technology.

What is HIBT?

HIBT, or the High-Interest Blockchain Token, is a platform designed to offer high-yield investment opportunities in the cryptocurrency space. It provides users with an innovative way to earn returns on their digital assets by leveraging blockchain technology. HIBT aims to connect investors with high-quality bond offerings, typically characterized by attractive interest rates and robust security features.

What is Coinbase’s Bond Platform?

Coinbase, a leading name in the cryptocurrency exchange industry, has ventured into the bond market by offering its bond platform. This platform allows users to invest in crypto-backed bonds, providing an alternative to traditional investing methods. Coinbase aims to simplify the process, ensuring that even those new to cryptocurrency investments can easily navigate their offerings. Their bond platform integrates user-friendly interfaces and robust security measures to protect investors.

Comparing the Platforms: Key Features

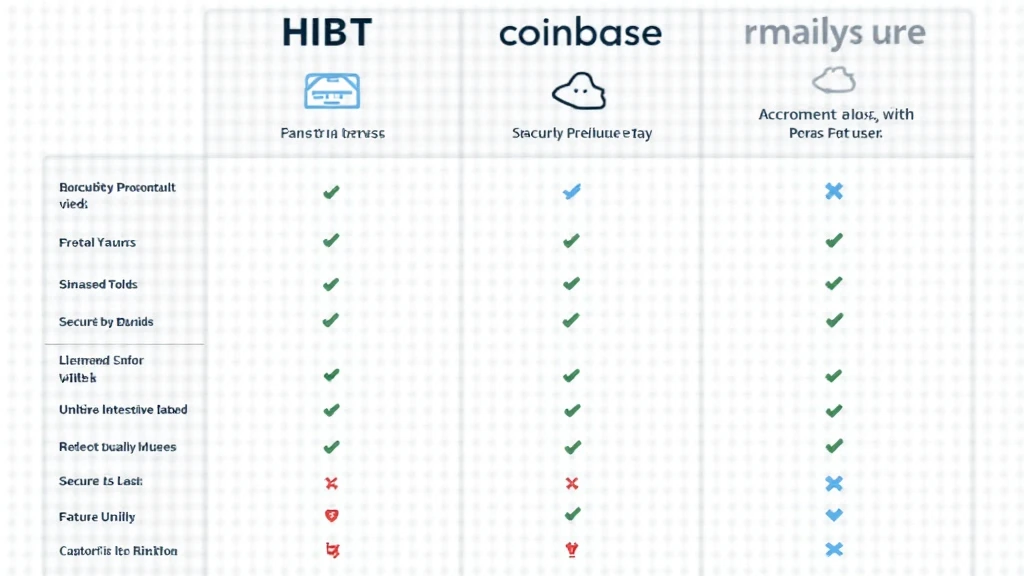

Let’s break down the crucial features that differentiate HIBT from Coinbase’s bond platform:

- Security Measures: HIBT uses advanced security protocols, including decentralized storage, to ensure user data safety. In contrast, Coinbase employs industry-standard security measures, including cold storage and two-factor authentication (2FA).

- User Experience: HIBT focuses on creating a streamlined experience for seasoned investors, whereas Coinbase prioritizes a user-friendly interface that caters to beginners.

- Returns on Investment: HIBT typically offers higher yields on investments than Coinbase, making it attractive for those looking for increased income potential.

Security: A Closer Look

As we delve deeper, security remains a pressing concern for both newcomers and seasoned investors in the cryptocurrency market. Let’s examine how HIBT and Coinbase handle security measures:

HIBT’s Security Protocols

HIBT implements a multi-layered security approach to safeguard users’ investments:

- Decentralized ledger technology ensures that no single entity has control over the entire system.

- Advanced encryption techniques protect user data and transaction integrity.

- Periodic audits and compliance checks bolster overall platform safety.

Coinbase’s Security Measures

Coinbase employs several robust security features:

- Cold storage of assets to minimize exposure to online threats.

- Two-factor authentication (2FA) for an additional layer of user protection.

- Regular security audits and compliance with regulatory standards.

User Experience and Interface

An essential factor in choosing between platforms is the user experience. Let’s assess how HIBT and Coinbase stack up in this area:

HIBT User Experience

While HIBT focuses on delivering a platform that seasoned investors can manipulate for maximum gain, it might seem daunting to novices:

- Advanced trading tools and analytics cater to experienced users seeking deeper insights.

- The interface, although sophisticated, might require a learning curve for new users.

Coinbase User Experience

In contrast, Coinbase emphasizes simplicity and ease of use:

- A beginner-friendly interface allows new investors to navigate easily.

- Educational resources, including tutorials and articles, help users understand the risks and potentials of investing.

Returns on Investment: HIBT vs. Coinbase

Let’s explore the potential returns investors can expect from both platforms:

Expected Yields from HIBT

According to recent reports in the crypto investing community, HIBT offers returns of around 8-12% annually. These high-interest rates are a significant draw for investors willing to take on higher risk in exchange for potentially greater rewards.

Expected Yields from Coinbase

Conversely, Coinbase typically offers lower returns, averaging around 4-6% annually. This conservative approach appeals to risk-averse investors who prioritize security over high yields.

Market Growth and Trends in Vietnam

As the crypto landscape evolves, Vietnam has shown promising growth, with the number of crypto users increasing significantly. With statistics indicating a 40% annual growth rate in cryptocurrency adoption since 2021, the potential for platforms like HIBT and Coinbase is undeniable. More Vietnamese investors are seeking options that align with their needs, especially in security and return potentials.

This is a prime opportunity for platforms operating in Vietnam to tap into this growing user base. By localizing their services and marketing strategies, they can effectively engage with the Vietnamese audience, catering to their unique preferences and investment goals.

Conclusion: Which Platform to Choose?

In conclusion, when comparing HIBT and the Coinbase bond platform, it’s clear that both platforms offer distinct advantages. HIBT provides higher yields and advanced tools for more experienced investors, making it appealing to those looking to maximize their returns. On the other hand, Coinbase excels with a user-friendly interface and solid security measures, catering primarily to beginners.

Ultimately, the choice between HIBT and Coinbase will depend on individual investment goals, risk tolerance, and personal experience in the cryptocurrency space. The broad growth in the Vietnamese market suggests that both platforms have the potential to thrive as more users seek innovative and secure means of investing in digital assets.

Disclaimer: This article does not constitute financial advice. Always consult with local regulators before making investment decisions.

For more insights on cryptocurrency investments and platforms, visit coincollectorcentral.