Vietnam Crypto Institutional Interest: Exploring the Landscape

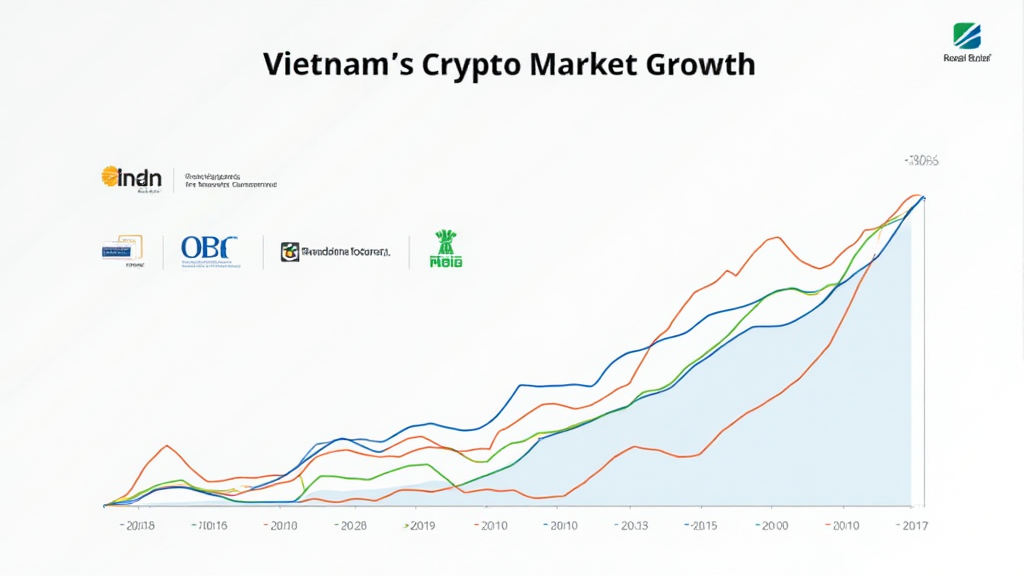

According to Chainalysis 2025 report, global institutional investments in crypto have surged, with Vietnam witnessing a notable increase in interest. In a rapidly evolving market, understanding the factors driving this trend is crucial for both investors and industry stakeholders.

Understanding Vietnam’s Institutional Investment Growth

In recent months, Vietnam has seen significant institutional interest in cryptocurrencies. This growth mirrors global trends where giants like BlackRock and Fidelity are entering the crypto space. You might have heard that a large number of Vietnamese businesses are beginning to allocate a portion of their portfolios to digital assets. Think of it as a family diversifying their dinner menu to include more international cuisines.

The Role of Blockchain Technology in Investments

Blockchain technology, which underpins most cryptocurrencies, is like a digital ledger that adds an extra layer of security and transparency to transactions. For institutions, this means less risk and more trust, akin to a bank ensuring that your money is safe and sound. Understanding how blockchain operates can help investors appreciate why it’s become an attractive option for institutions in Vietnam.

Regulatory Landscape and Its Impact on Institutional Interest

The regulatory environment in Vietnam is also evolving. Just as every city has its own traffic rules, Vietnam is developing regulations surrounding cryptocurrency investments. Clarity on these regulations can significantly affect institutional participation. Many are watching to see if the government introduces favorable policies that could mimic the proactive stances taken by other countries.

Future Trends: What Can We Expect?

Looking ahead, we anticipate that cryptocurrencies will increasingly be integrated into traditional finance. For instance, new financial products based on crypto assets will likely appear, similar to how customizable insurance products emerged in the past. Keeping an eye on trends is essential for any investor looking to navigate the Vietnamese crypto market effectively.

In conclusion, the Vietnam crypto institutional interest is not just a passing trend but represents a significant shift in the financial landscape. Staying informed will empower investors. For those eager to dive into this world, consider our downloadable toolkit that offers insights into managing crypto investments responsibly.

Download our Crypto Investment Toolkit!

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory bodies, such as the MAS or SEC, before making financial decisions.