Vietnam Blockchain Liquidity Pools: Navigating the Future of DeFi

According to Chainalysis 2025 data, a staggering 73% of blockchain liquidity pools globally are vulnerable to various threats. This statistic highlights the urgent need for enhanced security measures in the realm of decentralized finance (DeFi), especially in regions like Vietnam where blockchain solutions are rapidly gaining traction.

1. What Are Liquidity Pools?

Imagine you’re at a bustling market, with various stalls selling different goods. Each stall represents a liquidity pool, where traders can exchange assets. Liquidity pools are collections of cryptocurrencies locked in a smart contract, acting as the source for decentralized trading. They allow users to provide liquidity while earning a percentage of transaction fees. With Vietnam’s blockchain initiatives, these pools are becoming essential for local DeFi platforms.

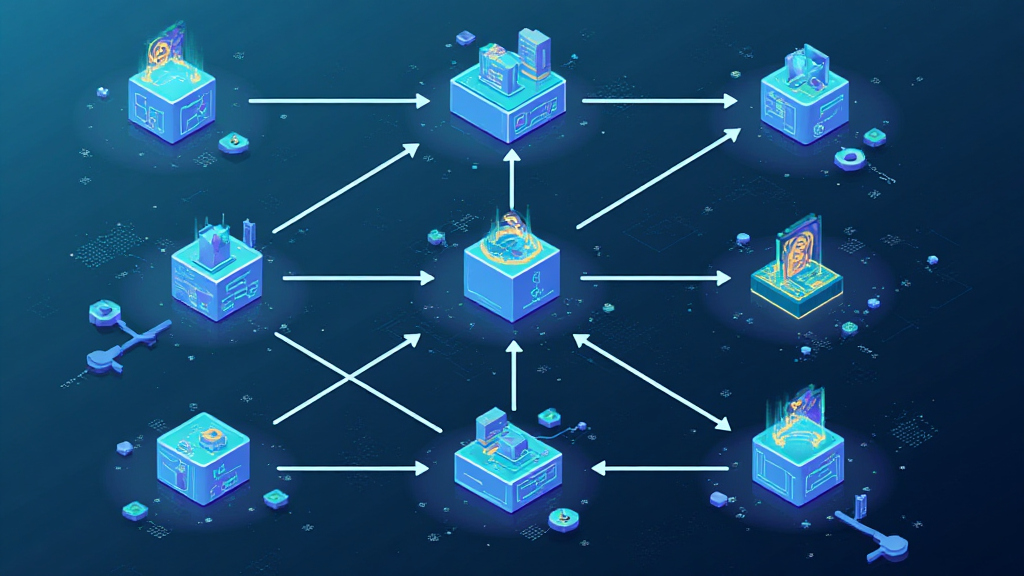

2. How Do Liquidity Pools Enhance Cross-Chain Interoperability?

Cross-chain interoperability is like having a polyglot at the market who can communicate and exchange goods between different stalls. These liquidity pools enable seamless asset transfers across multiple blockchains, enhancing overall market efficiency. If you consider the Ethereum and Binance Smart Chain ecosystems, liquidity pools serve as a bridge, facilitating smoother transactions and wider access to diverse tokens.

3. The Role of Zero-Knowledge Proofs in Enhancing Security

Think of zero-knowledge proofs as a secret code that only you and your friend know. In the context of liquidity pools, these proofs enhance security by allowing parties to prove they have certain information without revealing the actual data. As Vietnam focuses on integrating these advanced technologies, the risk of hacks and data breaches can be significantly reduced, ensuring a safer DeFi environment.

4. Vietnam’s Regulatory Landscape for Liquidity Pools

In 2025, the regulatory landscape for DeFi, including liquidity pools, is expected to evolve. Just as you would check the rules before setting up a stall in a market, crypto investors must understand local regulations. Vietnam’s regulatory frameworks are crucial for establishing trust and safety in blockchain transactions, potentially influencing global DeFi trends.

In conclusion, Vietnam’s blockchain liquidity pools present both opportunities and challenges in the evolving DeFi landscape. Understanding their mechanics and security measures is essential for anyone looking to participate in this space. For more comprehensive insights and resources, feel free to download our toolkit.

Check out our liquidity pool security whitepaper to learn more.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority before making any financial decisions.

For optimal security, consider using tools like Ledger Nano X, which can drastically reduce the risk of private key exposure by 70%.