Navigating HIBT Institutional Liquidity Pool: Insights on Depth Charts

With staggering losses of $4.1B from DeFi hacks in 2024, the importance of secure and reliable liquidity pools cannot be overstated. In the ever-evolving landscape of cryptocurrency, understanding the HIBT institutional liquidity pool and its liquidity depth charts is crucial for investors looking to safeguard their assets and optimize returns. This article aims to provide comprehensive insights into these concepts, exploring how they can impact your investment strategy and enhance your understanding of market dynamics.

Contextualizing HIBT Institutional Liquidity Pools

The HIBT institutional liquidity pool serves as a critical component in the cryptocurrency trading ecosystem. As institutional investors continue to enter the market, the demand for reliable liquidity has surged. Liquidity pools allow these investors to trade large volumes without causing significant price fluctuations.

- Institutional Participation: In recent years, institutional interest in cryptocurrencies has skyrocketed, particularly in Vietnam where user growth rates have reached astonishing figures. According to recent studies, the adoption of digital assets in Vietnam increased by over 40% in 2023.

- Benefits of Liquidity Pools: Such pools minimize slippage, enhance price stability, and provide investors with easier access to large trade volumes.

- Market Dynamics: The liquidity depth of these pools is particularly instrumental in shaping market trends. Understanding these depths can provide a strategic advantage for investors.

The Mechanics of Liquidity Depth Charts

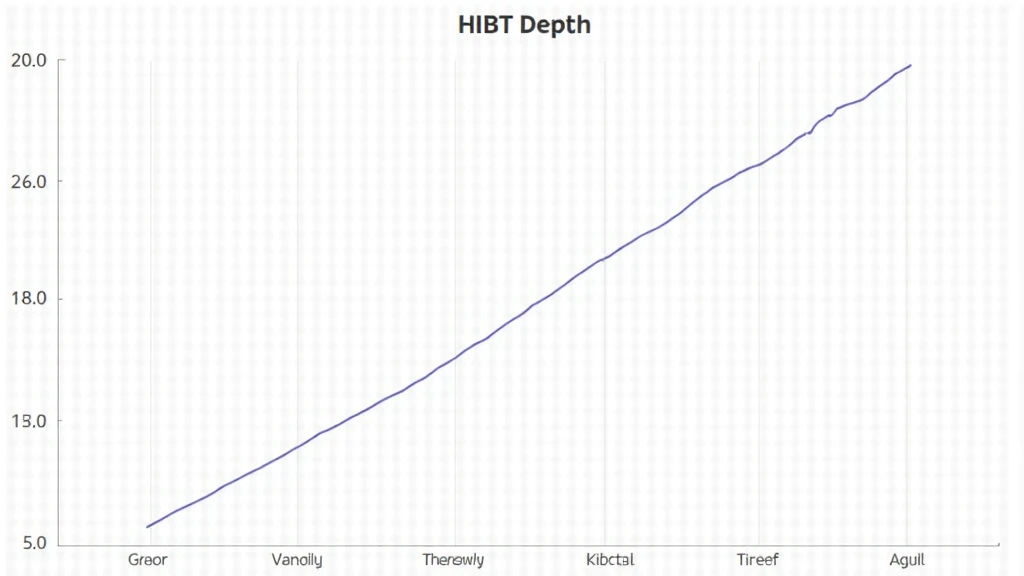

Liquidity depth charts visually represent the available liquidity at various price levels within a liquidity pool. They serve as a crucial tool for traders and investors alike, facilitating strategic decision-making.

Here’s a basic breakdown of how these charts work:

- Bid and Ask Prices: Depth charts display the relationship between buyers (bids) and sellers (asks) at different price levels. A deeper pool indicates that there is a large volume of buy and sell orders.

- Price Impact: As investors place large orders, understanding the liquidity depth allows them to gauge the potential price impact before executing trades.

- Market Signals: The liquidity depth charts can serve as market indicators, showing where potential resistance or support levels lie based on the accumulation of orders.

For instance, if a trader is looking to buy a substantial amount of HIBT tokens, by analyzing the depth chart, they can identify price ranges where the liquidity will support their order without causing excessive price slippage.

Factors Influencing Liquidity Depth

Liquidity depth is influenced by numerous factors, which traders and investors must take into account. Let’s break it down:

- Market Sentiment: Positive sentiment often leads to increased trading volumes, enhancing liquidity.

- Regulatory Changes: Compliance with regulations can instill trust in investors, thereby boosting participation in HIBT pools.

- Technological Advancements: Innovations such as automated market makers (AMMs) have transformed the way liquidity functions, allowing for more dynamic pools.

In Vietnam, understanding these factors is particularly important, as regulatory frameworks are evolving quickly, impacting how liquidity is structured and accessed.

Investing Strategies for HIBT Liquidity Pools

Investors aiming to profit from HIBT liquidity pools should consider several strategies:

- Dollar-Cost Averaging: Utilizing average cost strategies can help mitigate the risks associated with market volatility.

- Liquidity Mining: Engaging in liquidity mining can yield attractive rewards while increasing liquidity depth.

- Staying Informed: Follow market trends and updates regularly. Use charting tools to monitor changes in liquidity depths.

Effective investment in HIBT pools necessitates a keen understanding of both the technology involved and the regulations governing this sector, especially given the rapid changes taking place.

Understanding Risks Associated with Liquidity Pools

While there are many opportunities with HIBT liquidity pools, there are inherent risks that investors must acknowledge:

- Impermanent Loss: This risk arises from changes in the price ratios of the assets in the liquidity pool, potentially leading to losses compared to holding assets independently.

- Market Manipulation: Given the volatile nature of crypto markets, deep liquidity pools can also attract manipulative practices.

- Smart Contract Vulnerabilities: Like any other DeFi protocol, vulnerabilities within the smart contract code can lead to potential hacks.

It’s vital for investors to conduct thorough research and auditing before participating in any liquidity pool.

Real-World Examples of Successful Liquidity Management

To further illustrate the concept of HIBT institutional liquidity pools and depth charts, let’s examine some case studies:

- Case Study 1: A well-regarded crypto exchange successfully utilized depth charts to execute a $50 million trade while maintaining price stability. They analyzed liquidity depths to determine optimal entry and exit points.

- Case Study 2: A DeFi project focused on liquidity mining offered higher incentives to users contributing to its liquidity. By monitoring the liquidity depth, they attracted institutional participation and achieved greater market share.

These examples highlight how strategic liquidity management can lead not only to successful trades but also to a more robust market presence.

Conclusion: The Future of HIBT and Institutional Liquidity Pools

The HIBT institutional liquidity pool and its liquidity depth charts represent a pivotal segment of the cryptocurrency market. As the landscape continues to evolve, understanding these concepts will empower investors to make informed decisions. By examining trends, staying vigilant on liquidity depths, and adopting careful strategies, traders can not only enhance their knowledge but also their potentials for success.

For any crypto investor, especially within the dynamic Vietnamese market, being equipped with insights on liquidity pools and depth charts proves to be invaluable.

As the crypto realm advances, it becomes critical to stay abreast of developments and continually educate oneself on instruments and strategies — after all, informed decisions create the foundation for successful trading.

At coincollectorcentral, we are dedicated to providing you with the tools and insights necessary to navigate this complex landscape. For further reading, check out more articles on deep liquidity pools and their implications.

**Authored by Dr. Alex Thompson, a blockchain specialist with over 15 years of experience in the field, having published 30 papers and led audits for well-known projects, Dr. Thompson offers leading insights into the realm of cryptocurrency and DeFi.”**