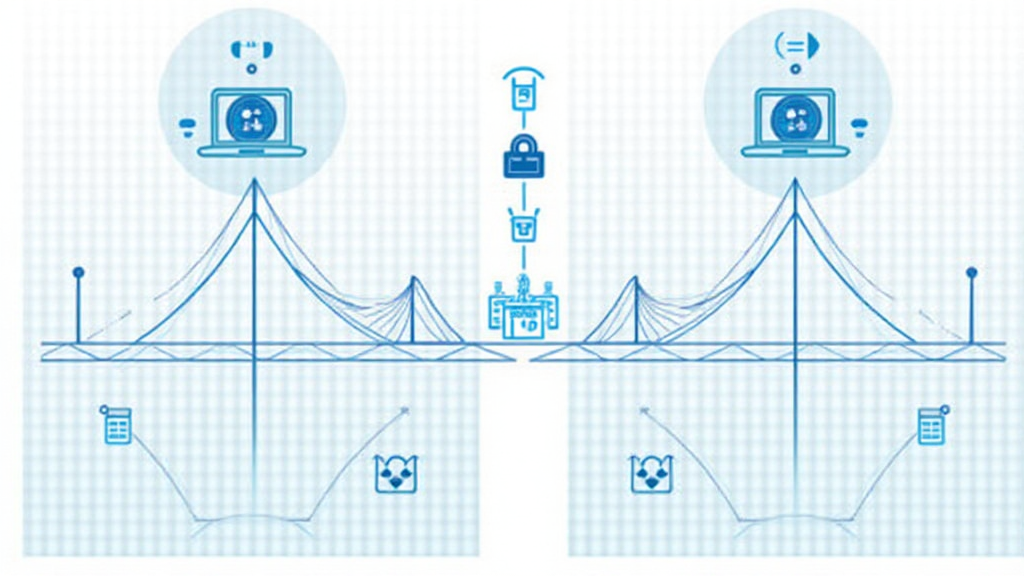

Understanding Cross-Chain Bridges

Imagine a currency exchange booth that allows you to swap your dollars for euros. Cross-chain bridges act similarly, enabling transactions between different blockchain networks. However, Chainalysis reported that a staggering 73% of these bridges have security vulnerabilities. Therefore, understanding how to audit them against HIBT benchmark comparisons is crucial for investors navigating the DeFi landscape.

Security Challenges in Cross-Chain Transactions

Like a busy market facing theft, cross-chain transactions encounter various risks. Many bridge hacks occur due to smart contract flaws, where bad actors exploit vulnerabilities in code. According to CoinGecko’s 2025 data, over $1 billion has been lost in such hacks. Evaluating security through HIBT benchmark comparisons reveals weaknesses and helps traders avoid pitfalls.

Benefits of Zero-Knowledge Proof Applications

Zero-knowledge proofs allow verification of transactions without revealing sensitive information. Think of it as checking the authenticity of a bill without showing its denomination. These applications enhance privacy and security in the DeFi space. Utilizing HIBT benchmark comparisons can further demonstrate the effectiveness of zero-knowledge proofs against traditional methods, attracting more users to the ecosystem.

The Future of DeFi Regulations in Singapore

As we look towards 2025, Singapore’s approach to DeFi regulation will set a precedent. With evolving laws, understanding the implications of HIBT benchmark comparisons can inform stakeholders about compliance requirements. You might have heard of companies adapting swiftly to regulatory changes; it’s vital to stay ahead in this competitive landscape.

In conclusion, as the DeFi space evolves, using HIBT benchmark comparisons for security assessments, privacy solutions, and understanding impending regulations becomes increasingly critical. Download our toolkit to explore more on this topic.