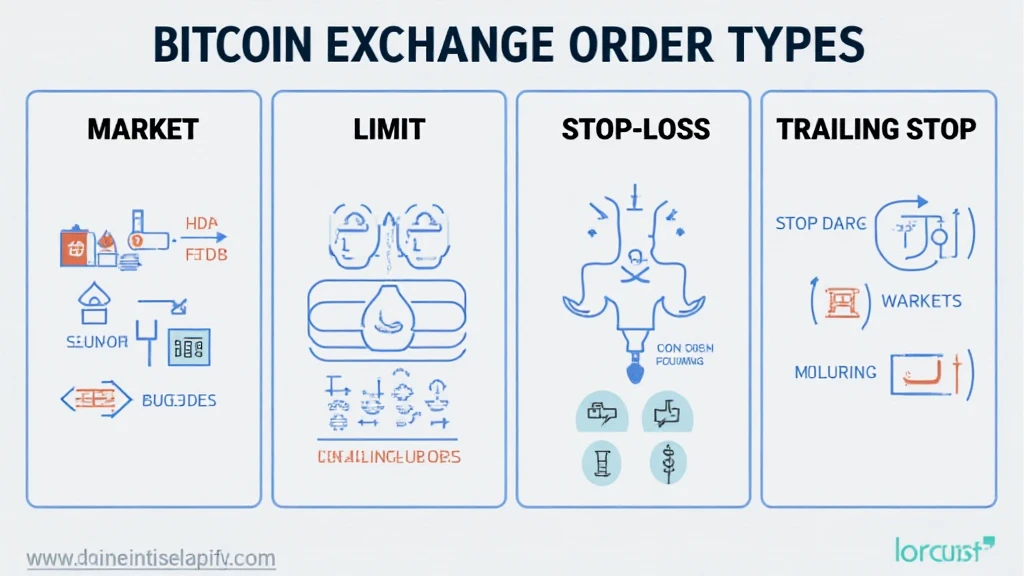

Understanding HIBT Bitcoin Exchange Order Types

As the cryptocurrency market continues to evolve, understanding the intricacies of trading platforms becomes increasingly vital. According to recent data, the volatility of Bitcoin and other cryptocurrencies led to a staggering $4.1 billion lost to hacks in 2024, underscoring the need for secure trading environments. HIBT Bitcoin exchange offers various order types to facilitate both novice and experienced traders in navigating this complex market effectively.

Why Choosing the Right Order Type Matters

Choosing the right order type at HIBT Bitcoin exchange can dramatically affect your trading strategy. Just like a skilled chef selects the appropriate knife for precise cuts, a trader must select the right order type to manage risk and maximize potential gains. Each order type serves a specific purpose and aligns with different trading strategies.

Market Orders

Market orders are one of the simplest order types available. Traders utilize market orders when they wish to buy or sell Bitcoin immediately at the current market price. This type of order guarantees execution but does not guarantee the price. Here’s a quick rundown:

- Pros: Immediate execution, simple to use.

- Cons: May experience slippage, especially in volatile markets.

Limit Orders

Limit orders allow traders to set a specific price at which they are willing to buy or sell Bitcoin. This provides control over the trade, ensuring no transaction occurs at an unintended price:

- Pros: Price control, no unexpected executions.

- Cons: May not execute if the market does not reach the set price.

Stop-Loss Orders

For risk-averse traders, stop-loss orders are essential. They enable traders to limit potential losses by automatically selling Bitcoin at a predetermined price. Similar to a safety net, these orders are crucial for minimizing risk:

- Pros: Protects against significant losses, easy to implement.

- Cons: May execute during temporary dips in price.

Understanding Advanced Order Types

While market, limit, and stop-loss orders are standard, HIBT Bitcoin exchange also provides advanced order types for seasoned traders:

Trailing Stop Orders

Trailing stop orders adjust the stop price at a fixed percentage or dollar amount below the market price when the market price increases. This order type locks in profits while allowing for continued potential gains:

- Pros: Profit protection, flexible adjustments.

- Cons: Requires active monitoring of the market.

Fill or Kill Orders

Fill or kill orders are designed for the immediate execution of large orders, either entirely or not at all. This strategy is beneficial when dealing with significant price movements:

- Pros: Quick execution.

- Cons: May fail to execute if market conditions are unfavorable.

Navigating HIBT’s Unique Features

HIBT Bitcoin exchange offers unique features that complement these order types, making them even more effective for traders.

User-Friendly Interface

The HIBT platform boasts a user-friendly interface, which simplifies the trading experience for both beginners and experienced traders. Whether executing a market order or a limit order, users can easily navigate and set their trading parameters.

Advanced Charting Tools

Traders can access advanced charting tools that provide real-time data, aiding users in making informed decisions based on market movements. The integration of these tools with order types can lead to more strategic trading.

Impact of Local Market Trends in Vietnam

With Vietnam witnessing a rapid surge in cryptocurrency adoption, data shows an impressive 64% growth in users engaging with digital assets in 2023. This emphasizes the necessity for local exchanges like HIBT to offer tailored order types that resonate with the trading behaviors specific to the Vietnamese market.

How to Select the Right Order Type at HIBT

Selecting the right order type involves analyzing your trading strategy, risk tolerance, and market conditions:

- Assessing Risk: Understand your risk tolerance before selecting an order type.

- Market Conditions: Keep abreast of the market to choose appropriate strategies.

- Trading Goals: Align order types with your overall trading goals, whether short- or long-term.

Conclusion

Finally, understanding the different order types available at HIBT Bitcoin exchange is crucial for every trader aiming for success in the evolving world of cryptocurrency. From market orders for immediate trades to advanced options like trailing stops, knowing how to navigate these can greatly enhance your trading strategy. As the Vietnamese market continues to grow, platforms like HIBT will be vital in empowering traders with the tools necessary for informed and strategic trading.

About the Author

Travis Nguyen is a cryptocurrency researcher with expertise in blockchain technology, having published over 25 papers on various aspects of digital currency management. He has led audits for several notable projects and offers insights into enhancing trading strategies.