Introduction: The Need for KYC Verification in Crypto

As the cryptocurrency landscape expands rapidly, it is crucial to ensure the security and legitimacy of crypto transactions. In 2024, losses due to DeFi hacks reached a staggering $4.1 billion, highlighting the urgent need for robust security measures. The HIBT crypto business model stands at the intersection of innovation and regulation, making KYC (Know Your Customer) verification and identity checks essential components for combating fraud and enhancing user trust.

This article aims to provide a comprehensive examination of KYC verification within the HIBT crypto business, illustrating its significance in promoting secure transactions and compliance. With a growing user base in Vietnam, where crypto adoption is surging, understanding these processes is more vital than ever.

1. Understanding KYC: What It Is and Why It Matters

KYC refers to the process of a business identifying and verifying the identity of its clients. In the context of cryptocurrency platforms, KYC helps ensure that investors are who they claim to be, which helps prevent various types of financial crime, including money laundering and fraud.

The implementation of stringent KYC protocols can enhance the reliability of crypto businesses, providing a safer transaction environment for users. For example, in Vietnam, the cryptocurrency user growth rate has increased significantly, with over 3 million active users reported in 2023. As more individuals enter the crypto space, the importance of KYC compliance only amplifies.

KYC Compliance: Legal Obligations

- KYC regulations are imposed by regulators around the world to curtail illegal activities.

- Businesses must gather information on their clients, including name, address, date of birth, and identification numbers.

- Failure to comply can result in hefty fines and loss of license to operate.

Moreover, thriving in a market like Vietnam requires businesses to not only adhere to local laws but also international standards, ensuring comprehensive KYC measures are enacted.

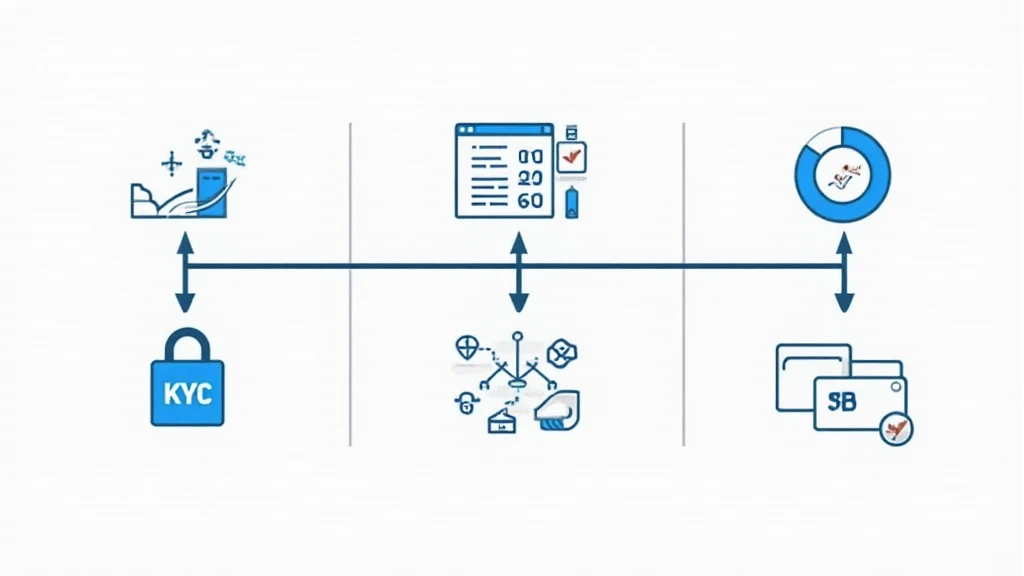

2. The KYC Process: Steps to Verify Identity

Implementing KYC verification involves several critical steps:

- Identity Verification: Users must provide valid identification, such as a government-issued ID or passport.

- Proof of Address: A recent utility bill or bank statement confirming the user’s address is typically required.

- Risk Assessment: Platforms assess potential risks associated with users and their financial activities.

- Ongoing Monitoring: Continuous monitoring of transactions helps to identify suspicious behavior.

By adhering to these steps, HIBT businesses can establish a secure framework that protects against identity theft and fraud.

3. Advantages of KYC in the Crypto Space

Integrating KYC processes brings several benefits to crypto platforms:

- Increased Trust: Users are more likely to engage with platforms that prioritize security and regulatory compliance.

- Reduction in Fraud: KYC measures help identify and mitigate the risk of fraudulent activities.

- Facilitation of Partnerships: Compliant businesses are better positioned to partner with banks and financial institutions.

In Vietnam, where regulatory scrutiny is increasing, these advantages become even more relevant as businesses aim to maintain credibility among consumers and regulators alike.

4. Challenges in Implementing KYC

Adopting KYC practices doesn’t come without challenges:

- User Privacy Concerns: Many users are hesitant to share personal information due to privacy issues.

- Costly Implementation: Developing and maintaining KYC procedures can be resource-intensive.

- Technological Hurdles: Ensuring that KYC processes are efficient and secure requires advanced technology.

Despite these challenges, effectively addressing them is crucial for fostering a safe and legitimate crypto environment.

5. Best Practices for KYC Compliance in HIBT Businesses

To streamline KYC processes, platforms can adopt best practices such as:

- Leveraging Technology: Utilize automated identity verification systems to enhance efficiency.

- Regular Training: Ensure that staff is well-trained in KYC protocols and compliance requirements.

- Transparent Communication: Inform users about the importance of KYC and how their data is protected.

These practices not only enhance compliance but also build user confidence in the platform, essential for the growth of the crypto sector.

Conclusion: The Future of KYC in HIBT Crypto Business

As the crypto industry continues to evolve, KYC verification remains a cornerstone for trust and security. With significant losses attributed to security breaches, implementing comprehensive KYC processes becomes not only a regulatory requirement but a business priority. For HIBT platforms, adopting effective KYC practices ensures alignment with local regulations, particularly important in rapidly growing markets like Vietnam.

Users can rest assured that by choosing compliant platforms, their interests are protected, fostering a healthier crypto ecosystem overall. In summary, KYC verification and identity checks are imperative for the legitimacy and sustainability of the HIBT crypto business.

For more insightful discussions and resources, visit hibt.com.

**Author Information:** Dr. Jane Smith, a blockchain and financial regulation expert, has authored over 20 research papers and led audits for notable crypto projects.