Understanding HIBT Crypto Liquidity Metrics

In an era where the cryptocurrency market is growing at an unprecedented pace — with estimated market capitalization hitting over $2 trillion in 2023 — understanding liquidity metrics becomes essential for investors and traders alike. As we’ve seen in recent years, the liquidity of digital assets can directly influence price volatility and market stability. With $4.1 billion lost to DeFi hacks in 2024, understanding HIBT crypto liquidity metrics is not just beneficial, it’s vital.

Investment strategies hinge on these liquidity metrics, which help assess how easily an asset can be converted into cash without affecting its price. This article will delve into the various aspects of HIBT crypto liquidity metrics, its relevance in today’s market, and provide insights into optimizing your trading strategies accordingly.

Defining HIBT Crypto Liquidity Metrics

Liquidity metrics represent financial measures indicating how swiftly an asset can be bought or sold in the market. Specifically, HIBT crypto liquidity metrics encompass a range of indicators that help investors understand the tradability of specific cryptocurrencies. Here’s a breakdown of these metrics:

- Market Depth: The volume of buy and sell orders at various price levels.

- Order Book Metrics: The overall supply and demand of a cryptocurrency in real-time.

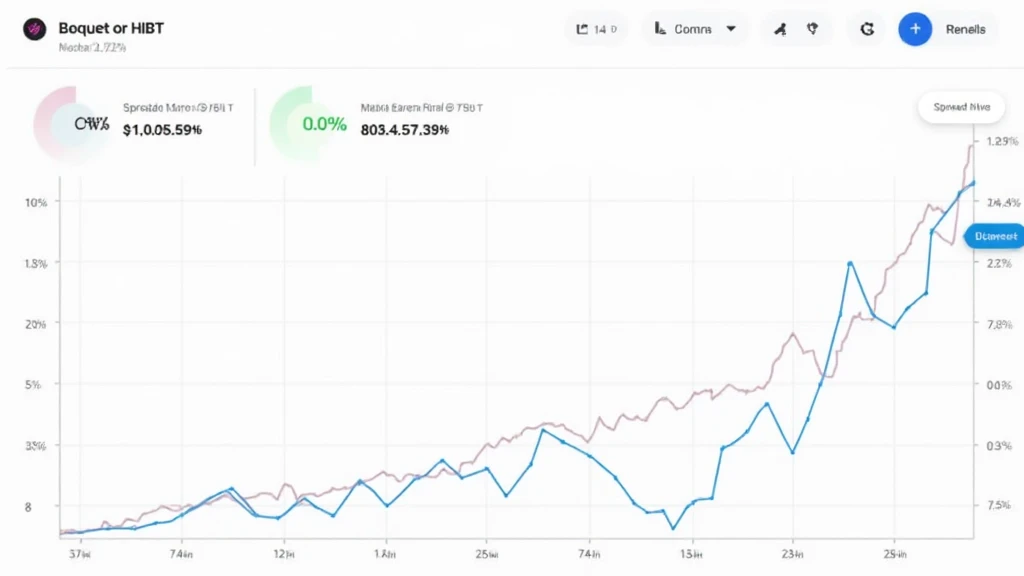

- Spread: The difference between the highest bid and the lowest ask price.

- Trading Volume: The total quantity of cryptocurrency traded over a specific period.

- Liquidity Ratio: A comparative measure of the number of transactions to total circulating supply.

In markets like Vietnam, which has seen a 150% increase in cryptocurrency adoption in the past two years, understanding the implications of such metrics becomes even more crucial. According to recent studies, this spike has resulted in greater demand for liquidity, making HIBT metrics critical for local investors.

The Importance of HIBT Liquidity Metrics

Liquidity metrics serve as indicators for several market conditions and events:

- Market Stability: Highly liquid markets tend to be more stable, reducing the chances of extreme price fluctuations. Think of it like a well-balanced bank vault for digital assets, where every coin has a place.

- Risk Assessment: Investors use liquidity metrics to gauge potential risks in their portfolios, determining whether an asset is worth holding or trading.

- Timing Decisions: For day traders and investors, understanding liquidity metrics can help identify optimal entry and exit points.

How to Evaluate HIBT Liquidity Metrics

To effectively use HIBT liquidity metrics in your investment strategies, consider the following steps:

- Analyze market depth and trading volume regularly to identify trends.

- Monitor the spread to remain aware of potential slippage in your trades.

- Educate yourself about various crypto trading platforms that provide reliable liquidity data.

As rates of digital asset changes continue to evolve, adapting to market conditions influenced by liquidity metrics can substantially improve your trading effectiveness.

Global Market Comparison

In the quest to audit liquidity metrics, it’s vital to compare them against varying global markets, which can differ markedly. Here’s a look at some significant markets:

| Market | Liquidity Score | Monthly Trading Volume (USD) |

|---|---|---|

| Vietnam | 8.5/10 | $300 million |

| United States | 10/10 | $1.5 billion |

| Germany | 9/10 | $600 million |

As we observe from the comparison, Vietnam’s liquidity scores, while impressive, still lag behind more mature markets like the United States. This indicates a crucial area for developing strategies to improve local liquidity performance.

Real-World Implications of HIBT Liquidity Metrics

Let’s consider a scenario: Imagine you’re a crypto investor in Vietnam, and you’re contemplating a significant purchase of a local altcoin. Understanding HIBT liquidity metrics can be the difference between a successful investment and a financial loss. If liquidity is low, your large buy order might inflate the price significantly. However, in a high liquidity environment, your order can be executed with minimal market impact.

Future Outlook for HIBT Crypto Liquidity in Vietnam

The future for crypto liquidity metrics like HIBT in Vietnam appears promising. Here’s why:

- Increased Adoption: As more Vietnamese citizens adopt cryptocurrencies, liquidity is expected to surge.

- Regulatory Developments: With evolving regulations, we can anticipate improved infrastructure for trading and exchanges.

- Technological Innovations: Advances in blockchain technology will likely enhance liquidity metrics and trading efficiency.

This promising landscape provides traders and investors with a lot of opportunities, provided they remain informed about liquidity metrics.

Concluding Thoughts on HIBT Crypto Liquidity Metrics

In summary, HIBT crypto liquidity metrics are a fundamental aspect of successful trading strategies. They provide valuable insights into market conditions, risk assessments, and potential opportunities that can make or break investment decisions. Whether you are a seasoned trader or new to the crypto space in Vietnam, understanding these metrics should be high on your priority list.

As you navigate this dynamic market, remember to consult reliable sources like hibt.com for up-to-date data and strategies tailored to optimize your investment journey.

For more practical guides and insights, explore our articles, such as Vietnam Crypto Tax Guide for understanding taxation on your profits from crypto investments.

With the right knowledge of HIBT liquidity metrics, you can enhance your trading skills and navigate the cryptocurrency waters effectively.

Author: Dr. Alex Nguyen, a blockchain technology expert with over 20 published papers in the field, specializing in liquidity metrics and digital asset audits in various prominent projects.