Navigating HIBT’s DeFi Liquidity Farming in 2025

As DeFi continues to rise, it’s critical to understand the inherent challenges of liquidity farming. According to Chainalysis, as of 2025, 73% of cross-chain bridges exhibit vulnerabilities. This issue highlights the urgency for robust solutions like HIBT’s DeFi liquidity farming that addresses these concerns effectively.

What is DeFi Liquidity Farming?

In essence, liquidity farming is akin to keeping veggies fresh in a market. Just as a vendor ensures freshness to attract buyers, liquidity providers supply their assets to platforms, enhancing the marketplace’s efficiency. With HIBT’s DeFi liquidity farming, users can earn rewards for lending their crypto assets, making it a savvy investment.

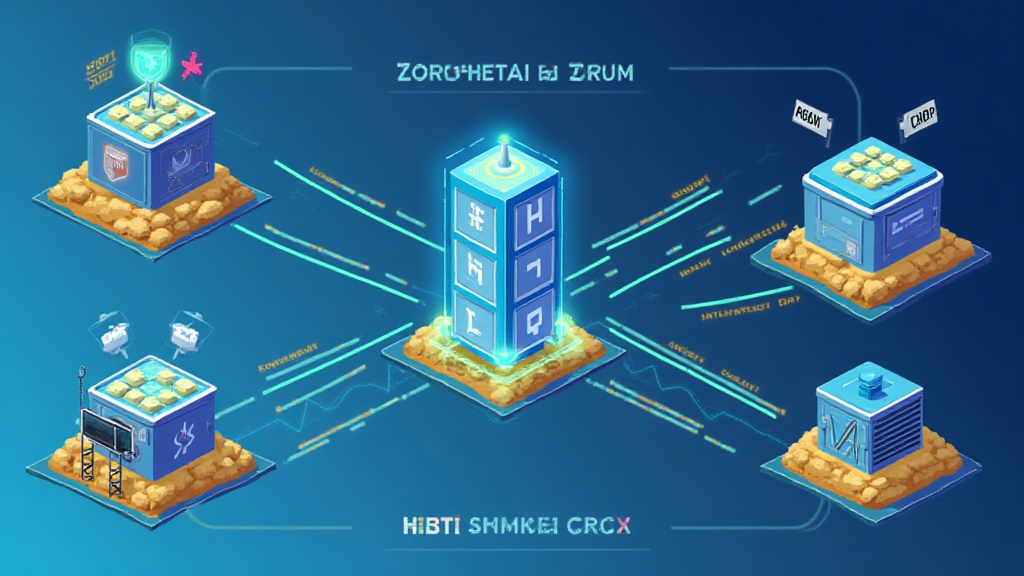

How Does Cross-Chain Interoperability Impact Liquidity Farming?

Think of cross-chain interoperability as a currency exchange booth. Users need seamless access to convert their assets between different blockchain platforms. HIBT’s DeFi liquidity farming facilitates this exchange, ensuring that assets can move freely and efficiently across various chains, significantly enhancing the user experience.

The Role of Zero-Knowledge Proofs in Enhancing Security

Imagine a magic show where the magician proves to the audience they haven’t touched a hidden card, without revealing the card itself. This is similar to how zero-knowledge proofs work; they ensure your transactions remain private while confirming legitimacy. HIBT’s DeFi liquidity farming employs these techniques to offer security and privacy to users, alleviating fears associated with DeFi activities.

The Future of HIBT’s DeFi Liquidity Farming in 2025 and Beyond

As we look forward, consider HIBT’s services like a reliable delivery service. Users can expect timely results in yield farming while securing their assets. With increasing regulatory scrutiny, especially seen in Singapore’s emerging DeFi regulations, HIBT is committed to compliance and adapting to new market demands.

In conclusion, HIBT’s DeFi liquidity farming stands at the nexus of innovation and security in the DeFi landscape. To further explore these opportunities and enhance your understanding, download our tool kit on navigating liquidity farming risks and strategies.

For additional insights, view our cross-chain security white paper or check our DeFi resources page for more information.

For expert advice, remember this article is not investment advice—always consult your local regulatory authority, like MAS or SEC, before making investment decisions. Protect your assets with a Ledger Nano X which can reduce private key leak risks by 70%.

Article by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standards Developer | Published 17 IEEE Blockchain Papers